Rigoblock

Rigoblock is a decentralized asset management platform. It aims to solve the problem of traditional asset management industry with blockchain and to remove the fees incentive structure by replacing it with GRG tokens. Rigoblock aims to solve the scalability, interoperability, and transparency from traditional asset management network that causes the industry to be very centralized, costly and full with unnecessary complexity.

Problems & Solution

- Scalability: The current asset management network is built on top of a complex platform that lacks scalability because there is no single and easy to use apps to manage the assets. Rigoblock will solve this by providing a streamlined, single and transparent platform where managers can build their own asset management apps, without any additional cost and requiring high technical expertise.

- Interoperability: Because there is no single and accepted work of flow between asset managers, it is hard to connect and manage or work together with each other. It is very costly and complex to connect each network. By using Rigoblock, every asset provider will be able to connect with each other when it is required.

- Transparency: Most traditional asset management business operated in a very complex process, which sometimes results in a lack of transparency. Some issues, for example, are low auditability, difficulty in auditing transactions from managers or firms and hidden cost that is not known where it ends. Rigoblock will fix this by using blockchain that tracks every transactions and process that happens in the network. It will also solve the conflict of interest problems where firms or managers try to get as much fee as possible while the customer wants it as cheap as possible using GRG tokens.

The Team, Company & The Advisors

According to LinkedIn, there are at least 6 people who've confirmed that they're working in Rigoblock. On the other hand, Crunchbase told us that there is at least 11 to 50 people working in Rigoblock. Rigoblock is active since 2016, with the name of Rigo Investment Sagl GmbH. They're located in Via Domenico Fontana 8, Lugano, Switzerland according to Bloomberg.

Here's the team:

- Gabriele Rigo

LinkedIn Profile: https://www.linkedin.com/in/gabrielerigo/

Position:

a. Smart Contract R&D (according to Rigoblock website)

b. CEO & Founder (according to LinkedIn profile) - Hanna Keskin

LinkedIn Profile: https://www.linkedin.com/in/hanna-keskin-992263bb/

Position:

a. Co-founder (according to LinkedIn profile)

b. Operations & Public Relations (according to Rigoblock website) - David Fava

LinkedIn Profile: https://www.linkedin.com/in/favadavid/

Position:

a. UX & UI Lead (according to Rigoblock website & LinkedIn profile)

b. Co-founder (according to LinkedIn profile) - Nathalie Cadlini

LinkedIn Profile: https://www.linkedin.com/in/nathalie-cadlini-1109b8a7/

Position: SMM (according to LinkedIn profile) - Luca del Bianco

LinkedIn Profile: https://www.linkedin.com/in/lucadelbianco/

Position: Project Lead Developer (according to LinkedIn profile) - Frederico Obialero

LinkedIn Profile: https://www.linkedin.com/in/federico-obialero-962a9299/

Position: Full Stack Developer (according to LinkedIn profile)

All of this member has at least 1 or 2 years experience in their respective position. The key member who looks to have a lot of experience in the asset management industry is Gabriele Rigo. He has at least 10 years of active engagement in the asset management industry with various companies, such as Mangart, Lemanik and Rigo Investment. This is important because, without experience in this industry, the project will likely fail to deliver what they promise because lack of understanding of the area they wanted to solve.

The rest of the team has at least 1 year in their respective field. It is good to see that the CEO is embracing young and enthusiastic workers to run this startup. Some might think that the team is not that good because their experience is limited, but that is not entirely true when we consider the advisor and the other team, and the fact that this project is a continuation from the previous successful business, Rigo Investment.

Here is the advisor of Rigoblock:

- Mikael Olofsson

LinkedIn Profile: https://www.linkedin.com/in/mikael-olofsson-9a865135/

The participation of Mikael in Rigoblock is not yet confirmed on his LinkedIn profile - Alberto Robbiani

LinkedIn Profile: https://www.linkedin.com/in/alberto-robbiani-86a55ab5/

The participation of Alberto in Rigoblock is not yet confirmed on his LinkedIn profile - Primoz Kordez

LinkedIn Profile: https://www.linkedin.com/in/primoz-kordez-frm-9878b463/

The participation of Primoz in Rigoblock is not yet confirmed on his LinkedIn profile - Santosh Pandey

LinkedIn Profile: https://www.linkedin.com/in/thesantoshpandey/

The participation of Santosh in Rigoblock is not yet confirmed on his LinkedIn profile - Riccardo Pittis

LinkedIn Profile: https://www.linkedin.com/in/riccardopittis/

The participation of Riccardo in Rigoblock is not yet confirmed on his LinkedIn profile

All of those advisors have a lot of experience in their respective field. The majority of the advisor has at least 10 recommendations from other LinkedIn profile and have at least 10 years of experience. The advisor looks good enough in order to help Rigoblock in order to achieve their goal with the necessary business management, legal compliance, blockchain economics and so on.

GitHub Activity

Rigoblock GitHub repository address is https://github.com/RigoBlock. There are three people who've been actively contributing on the code, and as you might guess it is Luca, Federico and David. There are several directories and some of them were created in 2017. Here are the full directories:

- https://github.com/RigoBlock/PR

- https://github.com/RigoBlock/whitepaper

- https://github.com/RigoBlock/RigoBlockPaper

- https://github.com/RigoBlock/SolidityCasper

- https://github.com/RigoBlock/Videos

- https://github.com/RigoBlock/RBIPs

- https://github.com/RigoBlock/rigoblock-parity

- https://github.com/RigoBlock/pool

- https://github.com/RigoBlock/rigoblock-local

- https://github.com/RigoBlock/RigoBlockRegistry.js

- https://github.com/RigoBlock/ERC20Exchange

- https://github.com/RigoBlock/ZEIPs

- https://github.com/RigoBlock/interfaces

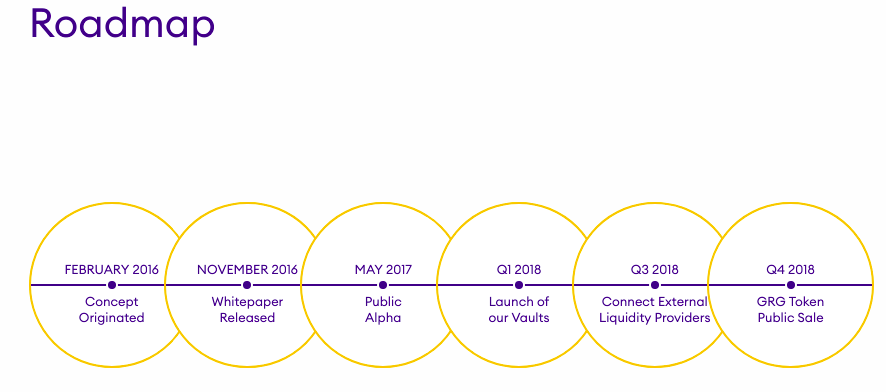

As you can see, the repositories contain more than just code, but also promotion materials. If we ignore the promotion materials, then the last activities on the repositories were in June 2018 (at the moment of this writing). However, their contributors, such as Luca is actively making commits and edits on private repositories. According to the roadmap, the development is starting since 2017, so it is not surprising to see that the repository was made 2 years ago.

It is not clear at the moment whether it is for Rigoblock or other projects. Even the activities are not that high, the beta platform is ready. We can try it and I'll probably do a review about it in the next article. However, it would be nice if the repositories are updated regularly as it leads to confidence and transparency.

Conclusion

While the GitHub activities are not that high, but the beta platform is ready. The team looks nice, especially with the CEO who has a lot of experiences in the asset management industry. The advisor is also good, however, all of them have not confirmed participation in Rigoblock on their LinkedIn profile. It would be great if they can confirm it to increase Rigoblock exposure and increase contributors trust in this project.

Bottom line: the beta is ready, team & advisor is good, let's see how they will pull it off.

Further reading:

- Rigoblock LinkedIn Details

- Rigoblock Crunchbase Profile

- Rigoblock Bloomberg Profile

- Rigoblock Website

- Rigoblock Whitepaper

Author (rawon ayam)

Bitcointalk Profil Link: https://bitcointalk.org/index.php?action=profile;u=1397196

Comments

Post a Comment