SYMMETRY FUND

SYMMETRY FUND

What is SYMMETRYFUND?

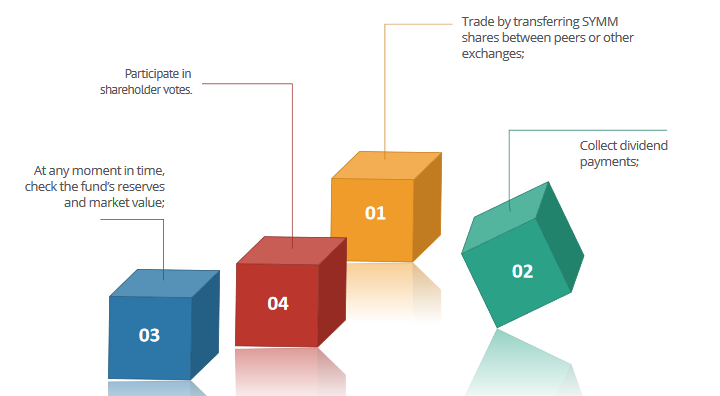

SYMM is a smart contract that complies with ERC20. The fund pays a monthly dividend in ET. A single section in the investment fund is a SYMM token. The investment fund trades and invests in ICO for crypto which includes Bitcoin, Ethereum, Ripple, Dash and Litecoin. Shareholders will have the ability to trade their tokens with peers based on market prices. This will allow the shareholders to cash in on the flow because the value of funds increases over time, along with receiving monthly ETH dividends.

SYMMRYRY Technology

As a technology company, SYMM offers an opportunity for individuals to gain exposure to the cryptocurrency market without the complexities of managing their own trade and related technologies. Embedded in ETH block, SYMM is a token corresponding to ERC20.

It is embedded in blocking ETH as a smart contract. Other SYMM financial functions will also be supported by blockchain contracts including ICO management, dividend payments, transparency actions, and voting.

There are several smart contracts that will operate throughout the different SYMM funding phases from the ICO phase to the trading phase. This contract handles various parts of the fund. For example, when an investor buys a SYMM share in exchange for a token in the ICO phase, the contract will take action to supply SYMM shares in exchange for tokens.

ICO SYMMETRYFUND

An unlimited number of SYMM estimates will be released at the SYMM Initial Offering Offer (ICM). ICO will be open for a period of 121 days at a rate of 0.1 ETH per SYMM. A SYMM token will represent a share of the funds. From ICO, most of the funds raised will be used for trading purposes. A small portion of the collected funds (up to 10%) will be held by a reserve fund and careful administration. Reseating these funds is part of the SYMM risk mitigation measures.

There will be at least two ICO rounds:

- First Round begins on December 10, 2017, and continues until February 10, 2018.

- Act Two begins on February 11, 2018, and continues until April 10, 2018.

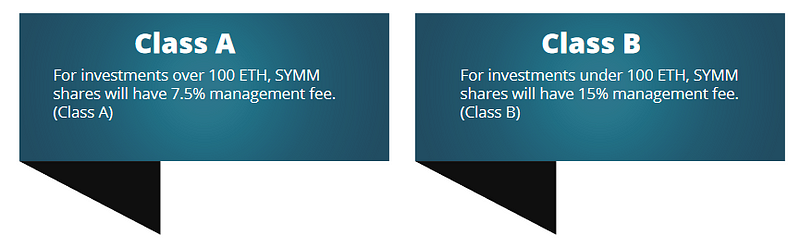

There will be 2 classes of stock:

Round One - the same management costs, only Class A shares are available.

Round Two - different management fees for Class A and Class B shares.

Moving from ICO to the Trading Phase

ICO will be closed manually at the end of 60 days. This can be closed by the nominated administrator account. After the closing of ICO, funds will be withdrawn from the contract and exchanged for other currencies. To ensure that SYMM has no adverse impact on the market for trading, withdrawals from the ICO phase will be completed within days or weeks. Withdrawals will be settled on different exchanges to mitigate potential market impacts.

Summary of ICO SYMM

-One SYMM share equals one ERC-20 compliant token.

- The duration of ICO is 60 days from 30 November 2017 to 30 January 2018 ..

- During ICO, 1 SYMM share will be charged at 0.1 ETH.

- ICO Soft Cap is 3,000 ETH.

- No Hard Cap for ICO.

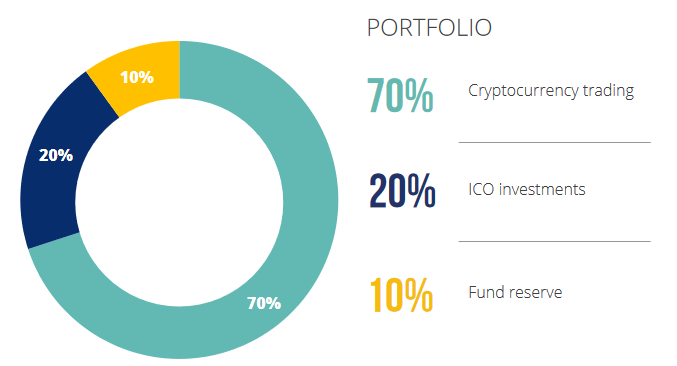

- Trading in BTC, LTC, DASH, ET and XRP will be made using 70% of the fund's capital.

- 20% of funds will invest in high-potential ICO. SYMM will secure deep discounts (up to 50%)

- ICO that has not been released for public sale.

- 10% of the funds will be held by the funds in the reserve to ensure that the entire fund is never exposed at all times.

- 50% of monthly trading profit will be paid dividends to investors every month. Dividends will be paid in ET.

- 50% monthly trading profit will be held for compounding growth.

- To reduce risk and ensure the stability of the value of funds, SYMM funds will be held in USD and EUR.

- Risk mitigation strategies will be undertaken.

- Management fee will not be charged if there is no profit.

- Under the scenario of symmetry and projected funds, the estimated annual ROI for the SYMM investor is estimated at more than 50%.

- All shareholders will have the opportunity to vote on a major fund decision, which further encourages trust and sparency between the fund and its shareholders.

- All transactions performed by SYMM will be detailed in the relevant exchanges.

- Funds held by SYMM will be subject to external audit every month.

- The balance of the account and the value of the SYMM funds will be reported to the stockholders on a daily basis.

- Until SYMM is listed on the main exchange, all shareholders will have the ability to sell their investments for instant liquidity

Trading Phase

After ICO successfully closed and funds withdrawn from ICO, the trading phase will begin. The trading phase will continue indefinitely with changes in trading activities such as traded pairs and the allocation of funds may be selected by shareholders.

At the start of trading phase, the value of SYMM capital will be from 90% of capital in ICO. This capital will be converted into fiat currency and quoted in USD.

Future of SYMMETRYFUND

The base currencies and other trading partners will be launched by SYMM as funds become more established and the initial ICO trading phase has matured.

The purpose of SYMM is to be able to provide various levels of risk to investors so that there is a solution for investors who are interested to have exposure to cryptography. As we launch new investment opportunities, and expand our funding, SYMM will investigate how investors can offer special offers and benefits for new offers.

ROADMAP

Team

Andrew Lewin - FUND MANAGER / CEO

David Steiner - FUND MANAGER / CEO

Markus Kohn - CTO

Harald Hantke - FUND STRATEGIST

Thomas Steinger - ASST FUND MANAGER

Oliver Purr - ASST FUND MANAGER

Vladislav Savochkin - BUSINESS MANAGER

Mykola Vdovychenko - LEGAL CONSULTANTS

Fatema Aktar Shathi - SMM EXPERT

ADVISOR

Peter Toh - ADVISOR

Mike Henkel - ADVISOR

Leah Kronshag - ADVISOR

Additional Information about SYMMETRYFUND:

Official website: https://symmetry.fund

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=2480514.0

Twitter: https://twitter.com/symmetryfund

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1397196

My Username Bitcointalk: Rawon ayam

My ETH wallet address: 0xeb9119547541f21C25e18d476D3D13DF2329eD4B

Comments

Post a Comment