Review of RxEAL

Review of RxEAL

About RxEAL

RxEAL is an unreliable and secure deposit storage security platform in the Ethereal block. This provides a decentralized dispute resolution with a primary focus on real estate market and automotive rentals worth hundreds of billions of dollars combined. RxEAL will also be available for other industries demanding unreliable storage of funds and fair dispute resolution. Deposit is the measure used to cover the losses suffered by the rental property. However, surrendering money to others for storage is a matter of trust. The paying party can not guarantee that the deposit has been securely stored and the other party will refund the deposit. Furthermore, at the conclusion of the agreement, it may take several weeks for the lessee to receive their refund,

Lease agreements by providing interrupts to these contracts require no technical knowledge. RxEAL not only solves the problem, but also provides faster deposit rates and cost-effectiveness compared to current chain solutions.

On the RxEAL user platform is able to generate smart contracts based on terms agreed by both parties. The contract will ensure that the deposit amount is kept securely in the Etaceum block during the term of the agreement without the possibility of unilaterally changing the contract or accessing the funds. In the event of a dispute concerning the final distribution of the deposit, our platform will provide a decentralized and independent arbitration by an eligible member who receives the RXL token to resolve the dispute.

By combining blockchain technology with everyday lease transactions, we can build an entirely new way for users with a lack of technical knowledge offered by smart contracts.

We believe that RxEAL is the answer to the growing demand of consumers involved in real estate, car rentals and other transactions involving

guarantee. We provide safer, faster and cheaper solutions than traditional alternatives.

RxEAL provides a way to safely save money for various rental products in the form of emergency crypto by using smart contracts on Ethereum block and fair dispute settlement process.

200,000 USD

Already invested by

private institutions and investors

What happens next?

Q3 2017

Test Market &

Concept Proof

Q4 2017 The Seeds

Successful DEC 4TH 2017 Launches RXL Sales Token JAN 31 2018 Launches Sales Token RXL Q2 2018 Expansion Q3 2018 C onboarded first in UK & US

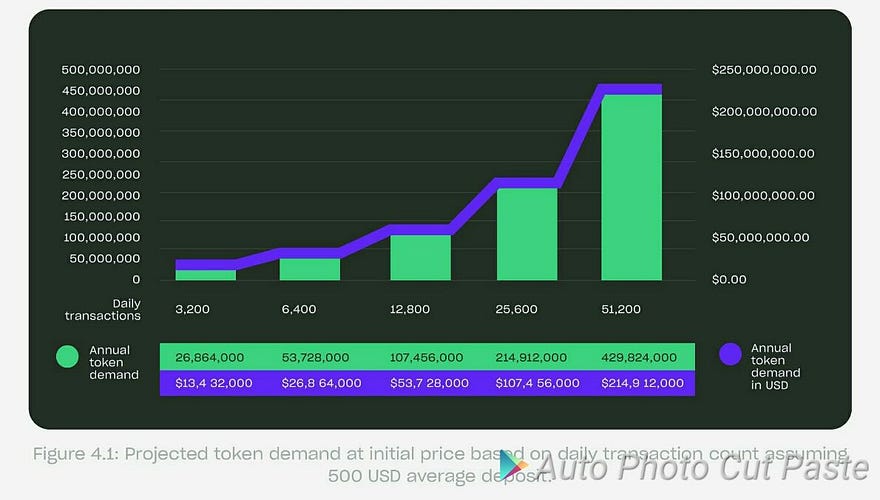

interaction with decentralized applications and smart contracts in the Ethereum ecosystem and ensuring a permanent security standard. The economic forces underlying the RXL token are of utility. The RXL Token allows exclusive access to services provided by the RxEAL platform, making it a utility token, not a speculative instrument. The RXL token value is directly correlated with the success of the RxEAL platform. Given a fixed token supply, the increased use of RxEAL services directly leads to a token value based on that being the unit required to pay for platform service fees. RXL tokens may be privately owned by holders, transferred to third parties or traded on the exchange. The default RXL token conversion rate is: 1ETH = 400 RXL. With the token distribution model and the number of tokens available on the market, the initial market capitalization will be equal to the amount of contribution to the distributed token. Token stored in reserves or can not be sold in public markets and can not affect the price so removed from the calculation. Only outstanding inventory is used to determine initial market capitalization rather than total supply. The initial maximum market capitalization after a revolutionary blockchain technology given its enormous market potential. Using the proposed service pricing model, the following token request estimates can be projected: the initial market capitalization will be equal to the amount of the contribution for the distributed token. Token stored in reserves or can not be sold in public markets and can not affect the price so removed from the calculation. Only outstanding inventory is used to determine initial market capitalization rather than total supply. The initial maximum market capitalization after a revolutionary blockchain technology given its enormous market potential. Using the proposed service pricing model, the following token demand forecasts can be projected: the initial market capitalization will be equal to the amount of the contribution for the distributed token. Token stored in reserves or can not be sold in public markets and can not affect the price so removed from the calculation. Only outstanding inventory is used to determine initial market capitalization rather than total supply. The initial maximum market capitalization after a revolutionary blockchain technology given its enormous market potential. Using the proposed service pricing model, the token demand forecasts can be projected: Token stored in reserves or can not be sold in the public market and can not affect the price to be excluded from the calculation. Only outstanding inventory is used to determine initial market capitalization rather than total supply. The initial maximum market capitalization after a revolutionary blockchain technology given its enormous market potential. Using the proposed service pricing model, the token demand forecasts can be projected: Token stored in reserves or can not be sold in the public market and can not affect the calculation. Only outstanding inventory is used to determine initial market capitalization rather than total supply. The initial maximum market capitalization after revolutionary blockchain technology is given its enormous market potential. Using the proposed service pricing model, the following is a start-up of a long-awaited revolutionary block technology. Using the proposed service pricing model, the following token request estimates can be projected: The initial maximum market capitalization after a round of contributions may prove conservative once a start-up becomes a well-established company offering a long-awaited solution supported by revolutionary blockchain technology given its enormous market potential. Using the proposed service pricing model, the following token request estimates can be projected:

Request Token

Daily transaction: 25,000

Annual token demand projected in USD:

Average Deposit Total demand

$ 300 $ 104,025,000

$ 600 $ 166,987,500

$ 900 $ 229,950,000

$ 1,200 $ 292,912,500

$ 1,500 $ 355,875,000

Condition

The sample request for RXL tokens in USD is equivalent to using the basic service cost model and assuming a 50% dispute rate.

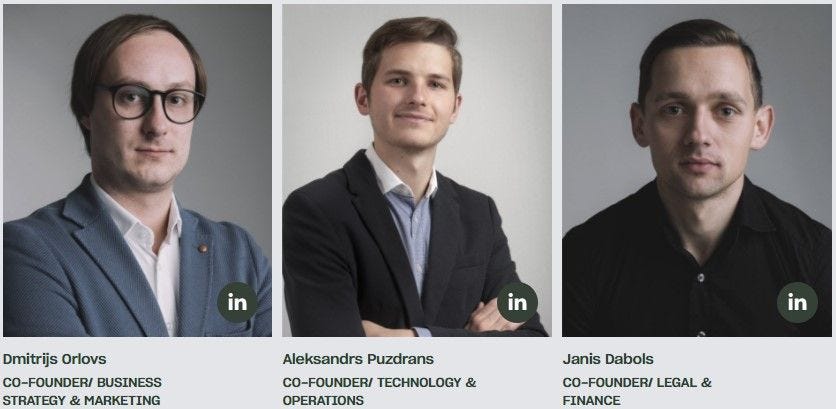

OUR TEAM

Below you can read general information about RxEAL team members, partners and project advisors

Dmitrijs Orlovs

Founder / Business & Marketing Strategy

Dmitrijs has gained a comprehensive experience in tax and finance while working in EY with companies such as L'Oréal, IBM, General Electric, Accenture and others. In addition, Dmitrijs has succeeded various projects in the field of IT, engineering and marketing. Dmitrijs also gained valuable sales and marketing experience while working as Head of Sales on hardware startup and while managing

related marketing projects in the largest retail chain in the Baltic -

Maxima,

leksandrs Puzdrans

Co-founder / Technology & operations

Aleksandrs established an agency specializing in the development of WordPress-based solutions with more than 20,000 clients from around the world choosing their products. Aleksandrs has studied international economics and commercial diplomacy and is always passionate about new technology, and while working on FinTech's related real estate project in 2016, he became an enthusiastic opportunity that can be given blockchain to improve the industry and eventually turns to the creation of RxEAL

Janis Dabols

Co-founder / Law & Finance

Janis is a graduate of the University of Latvia where she receives LL.B. Law and BSc in Finance in addition to graduating from Riga Graduate School of Law with LL.M. Law and Finance. He has worked as a financial market and global economic analyst, structured private equity and alternative investment funds, complex commercial real estate transactions and has provided financial, legal and tax consulting for companies and individuals with high net worth.

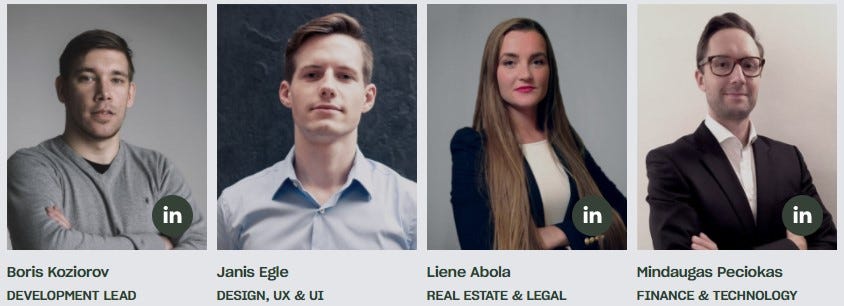

Boris Koziorov led the development

Boris is an expert and technical software engineer with vital experience in developing scalable projects and implementing software solutions for startup companies, internal systems and CRM. He has been the leader of the IT department team at Rention - a company that develops a complete property management and rental segment. Boris acts as a technology consultant and coordinator at various startups. In addition, Boris is a board member in a digital institution and he focuses on developing and deploying modern software solutions for various customers

Janis Egle, UX & UI Design

Janis is a talented web designer and has studied design at Baltic International Academy. He has set up a web design agency specializing in the development of WordPress-based products in 2011. Janis has participated in various

individual, corporate and government projects

and work as a packaging and graphic designer on the refresh brand DPJN Inc.

Ainis Dabols Ainis

Tax &

legal counsel has been working on taxes and legal issues for over twenty years and has proven himself to be an expert in the field. Currently, he is a Latvian Tax Advisory Board Member, where he represents the professional interests of tax consultants in discussions with representatives of the Ministry of Finance and Tax Administration officials.

As a financial and legal adviser, Ainis has participated in various investment and management projects, advising on tax planning, tax laws, tax risk evaluation and representing clients in financial and judicial authorities.

Liene Abola real estate & legal counsel

Liene is a very experienced expert

in various areas of law. For several years now he has worked with the construction of a law firm in Europe. Previously Liene had proved professionalism as an assistant judge in the county court, and later, the Supreme Court. As a lawyer, Liene has participated in various construction projects, providing legal consultation and evaluation on insurance, labor, construction, taxes, and special laws. Liene has also successfully participated in international legal disputes not only as a participant, but also as an arbitrator.

Andrew Johansson

US economic and real estate development adviser

Economic development specialists with the latest expertise in the following areas: economic impact analysis, corporate social responsibility (CSR) development, strategic consulting for Fortune 1000 companies, economic modeling, data visualization and analysis, and city finance. Prior to establishing his own direct appointment system from the owner of an economic development consultant, Andrew served as a consultant to the company and thinker at

United States, Finland, Latvia, Lithuania and Sweden.

Mindaugas Peciokas Teknologi

finance and consultation

Mindaugas has over nine years of experience in finance and accounting. He is currently based in Luxembourg working with private equity funds and global real estate. Influenced by the day-to-day operations of funds and companies, he also recognizes the legal and tax arrangements of funds and companies, as well as compliance and governance topics. He has extensive experience in the face of consolidation of complex multinational companies. Previously, Mindaugas worked as an auditor at KPMG for 5 years gained extensive experience in bank operations, insurance, pharmaceuticals, retail and manufacturing companies. Some of their clients are famous in the world including Nestle, Roche, Ergo and Nordea.

Mindaugas are also fans of IT. He's worked as a programmer with a number of startups such as penny auctions, CRM and real estate systems.

Mindaugas holds a bachelor's degree in Economics from the University of Leeds and is a member of ACCA. He also passed the CFA Level 1 exam.

Gunita Kulikovska business development adviser

Gunita's background lies in architecture, urbanism and urban strategy. He is a member of Forbes 30 under 30 and TEDx speakers. Archipreneur has also given praise, as he proclaimed one of the seven most inspirational women entrepreneurs in the field of architecture. In 2016, he and his colleagues set up a surviving startup company by embracing the VR as a new medium for building a better city. Clearly this is also recognized on the VR world map with the expertise of real-time VR web solutions. The company started as a frontier in the architectural design and empowerment projects such as NY Affordable Housing Challenge, Rail Riga Station Baltica and Astana Expo. The ambition to build a global business on new technology has resulted in an acceleration in the Startup list, Helsinki Helsinki and Slush list of 100 companies. a major operation based in London, England.

Kristaps Silent Strategy Advisor

Kristaps is one of the most renowned brands in Europe, with recent campaigns in Sweden, Germany and the Netherlands. His work has been featured in international media, including the New York Times. More than 20 award-winning award winning awards, including

"Oscar Strategy" - Golden Euro Effie in 2014 - makes

Kristaps as the most talented strategist in the Baltic. Forbes magazine also has known Kristaps in 30 under 30th rank in 2015.

Team

Counselor

Partners

- Scandiweb

- White label

- McCann Riga

Technology

Comments

Post a Comment