BQT

The aim of BQT is to build a community and culture of crypto traders utilizing our the Platform, helping the community and benefiting from the community. Therefore BQT provides secure, interactive and flexible P2P Trading Environment and user-friendly interface for its community to manage various types of transactions consisting of many crypto assets. BQT platform allows traders globally to negotiate their Crypto Asset trades directly interacting with each other and sharing their experience with the community. To leverage holdings of various Crypto Assets, BQT introduces the Hedge Trades system. Unlike Margins and Futures Trading, BQT Hedge Trade system is a flexible method for Traders of acquiring Crypto Assets for a short-term period by means of escrow of their existing Crypto holdings.

Simple example.

Trader A (Hedge Receiver) carries a BTC holding and posts an offer on the BQT P2P exchange providing his BTC into BQT Escrow with a 20% premium. He then invites other traders holding ETH to receive his BTC Escrow as collateral for 30 days while allowing him to use their ETH for that period.

Trader B (Hedge Provider) could respond to the offer and negotiate the terms by requesting a higher premium and/or shorter term. Trader C (another Hedge Provider) may also reply but with a different offer, negotiating better terms for the Hedge Receiver.

We Believe that Demand for desired acquisition of Crypto Assets can be fulfilled with significant Supply of various Crypto Asset Holdings and negotiated directly by Trader Peers.

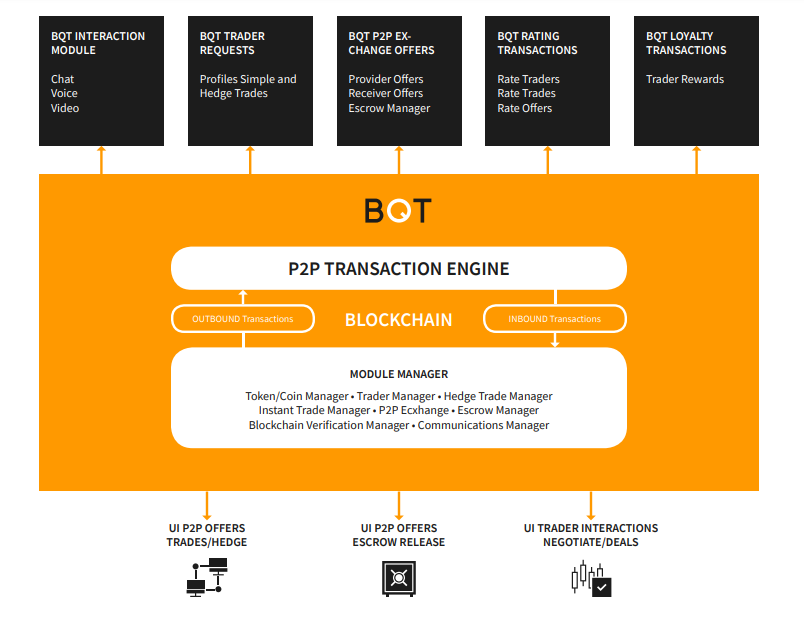

BQT SYSTEM WORK-FLOW

BQT P2P Platform utilizes secure and decentralized benefits of the Blockchain delivering flexible functionality for Traders world-wide.

Every module and database is programmed using various methods of encryption and ensures confidentiality and protection for Traders. 2FA configuration is a required setting for every Trader Profile.

BQTX TOKEN STRUCTURE AND ICO BONUSES

BQTX TOKENS ISSUED - 800,000,000

800 BQTX TOKENS = 1 ETH

600,000,000 Tokens will be frozen and would only be released as needed for company expansion, Marketing and Loyalty Programs to maintain token liquidity (up to 10% per year).

BQTX TOKEN DISTRIBUTION POST ICO (EXCLUDING FROZEN TOKENS)

Public — 57.5%Founders and Management — 20%ICO Advisors and Bounty Marketers — 2%Company — 20.5%

BUDGET ALLOCATION

Technology — 45%Marketing / Expansion — 35%Operations — 12%Other — 8%

Up here explanation from me and to avoid all forms of fraud please look for accurate and reliable information or visit the Link I provide below:

WEBSITE:https://bqt.io/

WHITEPAPER:https://bqt.io/assets/pdf/whitepaper.pdf

TWITTER:https://twitter.com/bqt_ico

TELEGRAM:https://t.me/BQTCommunity

Author (rawon ayam)

Bitcointalk Profil Link: https://bitcointalk.org/index.php?action=profile;u=1397196

Comments

Post a Comment