Zamzam

Blockchain-bank Zamzam launched a demo MVP in the form of a payment wallet: Zam.wallet. The main innovation of the product is that users can send money by mobile phone number, even if there is no timeless Zamzam's crypto wallet.

The demo version of Zam.wallet is available in various formats and can be used by users of the Web, iOS and Android devices. Currently, the system allows users to pay in four currencies: BTC, BTC Cash, ETH and Zamzam tokens. In addition to the transactions, the current version of Zam.wallet allows users to not only view account balances and transaction history, but also to create a new SMS-approved account on their mobile phone.

The process itself is uniquely arranged: users only need to enter the sum to be transferred and the mobile number of the recipient. If a creditor has not yet set up the Zamzam app yet, you will receive a link to save and download the app and a link to receive the money. If it does not record, the payment will be returned to the sender.

MVP currently works behind closed doors and is only available to a small group of investors. Officially, MVP will soon be open to the public.

In the future, Zamzam will make Zam.wallet an affordable and affordable platform for cross-border payments of both fiat and crypto currency. Visa and Mastercard card holders are also expected to use their credit cards, so that customers can pay for goods and services using Zamzam.

Namig Mamedov - new technical advisor to Zamzam

Namig Mamedov is a businessman, boss and public figure who has initiated numerous regional, national and international projects. He worked as a computer installation technician from Marko Bilgisayar Teknolojileri which is the chairman of Marko Casus Holding. He worked as an IBM representative in Azerbaijan. He speaks Turkish, Azerbaijani, Russian and English.

Namig Mamedov's projects have allowed to improve the quality of the communication system in Azerbaijan, and today the majority of the country's branch networks and government agencies operate on this network.

Under its leadership, decisions were made for the Tax Inspectorate of the Republic of Azerbaijan, including the initiation of a project to centralize and consolidate all tax reports on TIN (2002 )2003) with AVIS and a special data transmission network. The first automatic tax information system in Azerbaijan (2004 ilk2006).

Other projects:

2006 - Single Registration Window to simplify the registration of commercial enterprises;

2006 - Single Registration Window to simplify the registration of commercial enterprises;

2007 - a project for the establishment of a video conferencing system covering all aspects of the Ministry of Taxes, regional departments and departments;

2008 - electronic declaration system, for which legal entities and individuals have submitted all their declarations only electronically since 2008.

In the following years, Mamedov has started more than 10 projects, which significantly improve the working organization of the state institutions of Azerbaijan, and at the same time make a significant contribution to business development.

On February 6, 2014, Namig Mamedov was awarded with the Tereggi medal on the orders of the President of Azerbaijan.

In Zamzam, Namig Mammadov is responsible for the development of strategic partnerships, including the implementation of a tax center, for supporting further growth and development of Zamzam and for its expansion into the Azerbaijani market, and for liaising with and engaging with the heads of various companies. it makes an invaluable contribution to important decisions by contributing to the development of the project and contributing to its great experience.

Zam.exchange

Zam.exchange is a smart currency conversion system that offers the most appropriate exchange rate without spread (spread, the difference between the purchase rate and the sales rate). Zamzam is creating a future where people can access banking services quickly, safely and without intermediaries. The Zam.exchange module is integrated into the hike.wallet multicurrency wallet (here you can learn more about zam.wallet).

The current exchange transactions in Zam.exchange include Fiat / Fiat, Cryptocurrency / Cryptocurrency, Fiat / Cryptocurrency, Cryptocurrency / Fiat.

How Does Zam.exchange Work?

Zam.exchange connects to the largest traditional forex trading platforms through proprietary software that uses the FIX protocol, which is the international standard for exchanging data between exchange trade participants in real time. Zam.exchange connects to most crypto changes through the open-source Wrapper API developed by the Zamzam team and allows users to automate receiving requests from exchange servers. The module can be connected to the largest platforms by interacting over a single interface and maintaining maximum performance, security and flexibility.

Zam.exchange connects to the largest traditional forex trading platforms through proprietary software that uses the FIX protocol, which is the international standard for exchanging data between exchange trade participants in real time. Zam.exchange connects to most crypto changes through the open-source Wrapper API developed by the Zamzam team and allows users to automate receiving requests from exchange servers. The module can be connected to the largest platforms by interacting over a single interface and maintaining maximum performance, security and flexibility.

The module works with Machine Learning with the following tasks:

The user application analysis and

monitoring of a crypto set currency and forex exchanges which connect with the API

Zam.exchang to analyze all user requests and selects the most profitable platforms to achieve the lowest cost sales process for the user. We will publish a separate Road Map on how to use Machine Learning.

monitoring of a crypto set currency and forex exchanges which connect with the API

Zam.exchang to analyze all user requests and selects the most profitable platforms to achieve the lowest cost sales process for the user. We will publish a separate Road Map on how to use Machine Learning.

Islamic banking.

Islamic banking is a financial system based on Sharia law principles (legal Islamic provisions) and social justice, equal income distribution and unjust enrichment and speculation. This definition suggests that Islamic banking can better respond to the interests of its customers than traditional banks. Integration with the crypto money market is capable of placing it at the forefront of the modern banking sector. But first things first.

Islamic banking is a financial system based on Sharia law principles (legal Islamic provisions) and social justice, equal income distribution and unjust enrichment and speculation. This definition suggests that Islamic banking can better respond to the interests of its customers than traditional banks. Integration with the crypto money market is capable of placing it at the forefront of the modern banking sector. But first things first.

We propose to discuss the principles of Islamic banking in detail, to associate with other banking models and to analyze the practice with a time frame.

Is this a new period of financial relations?

Islamic banking is not very common, but is actively being developed. In 2016, total assets for Islamic banking were estimated at approximately $ 1.9 trillion. At the same time, more than 300 organizations work in more than 50 countries around the world according to Islamic banking principles. According to AlHuda-CIBE, the total volume of the Islamic financial market will reach $ 3 trillion by 2020 and the growth rate will definitely be higher than the traditional banking sector. Anyway, it is in many Muslim countries.

Islamic banking is not very common, but is actively being developed. In 2016, total assets for Islamic banking were estimated at approximately $ 1.9 trillion. At the same time, more than 300 organizations work in more than 50 countries around the world according to Islamic banking principles. According to AlHuda-CIBE, the total volume of the Islamic financial market will reach $ 3 trillion by 2020 and the growth rate will definitely be higher than the traditional banking sector. Anyway, it is in many Muslim countries.

The main differences from the Western banking system:

Prohibition of interest payment

Islamic banks do not demand interest (Riba), but they earn money in other ways. The truth is, they're turning into credit partners. There is no predetermined percentage that may be related to the value per credit or other lending conditions. The bank is analyzing a potential debtor's business project and evaluating its perspectives. If the result is positive, the bank becomes a partner to the borrower, thus sharing the risks with the client and making agreements on the division of business incomes. If a job fails, both the bank and the client will suffer. Thus, the bank acts as an investor.

Islamic banks do not demand interest (Riba), but they earn money in other ways. The truth is, they're turning into credit partners. There is no predetermined percentage that may be related to the value per credit or other lending conditions. The bank is analyzing a potential debtor's business project and evaluating its perspectives. If the result is positive, the bank becomes a partner to the borrower, thus sharing the risks with the client and making agreements on the division of business incomes. If a job fails, both the bank and the client will suffer. Thus, the bank acts as an investor.

The principle of risk-sharing and the increased social responsibility of Islamic banking correspond to the development of a new type of economy, called the sharing economy.

Protection of

contracts According to the principles of Sharia Law, the implementation of contractual obligations is obligatory for all parties. This rule reduces the risks for all participants.

contracts According to the principles of Sharia Law, the implementation of contractual obligations is obligatory for all parties. This rule reduces the risks for all participants.

Environmentally friendly financial activities such as

Islamic banking, tobacco, alcohol, weapons, etc. It prohibits the speculation and financial support of trade. Any gambling and derivatives are also prohibited because they pose a great risk.

Islamic banking, tobacco, alcohol, weapons, etc. It prohibits the speculation and financial support of trade. Any gambling and derivatives are also prohibited because they pose a great risk.

The role of Blockchain Since

Islamic ideology is based on justice and transparency that fits the principle of decentralization, Islamic banking and the block chain have some degree of convergence. Blockchain technology has great advantages that can be useful to the Islamic financial system. The most interesting part of Blockchain is the intelligent contract that could include the entire agreement between the Islamic bank and the borrower. Islamic banking can use these opportunities to improve business processes and optimize operations due to the use of decentralized systems.

Islamic ideology is based on justice and transparency that fits the principle of decentralization, Islamic banking and the block chain have some degree of convergence. Blockchain technology has great advantages that can be useful to the Islamic financial system. The most interesting part of Blockchain is the intelligent contract that could include the entire agreement between the Islamic bank and the borrower. Islamic banking can use these opportunities to improve business processes and optimize operations due to the use of decentralized systems.

The unification of these systems will play an important role in the development of the Islamic financial sector. For example, it can modernize legal documentation, reduce processing times of transactions and costs and transaction fees for providers.

Myths and Islamic banking.

The realization of the Islamic financial system is carried out by the zamzam through the goverment fund, which undertakes the support of young professionals and the main goals of the development of Muslim social infrastructure. The Zamzam fund is controlled by 12 recognized imams around the world.

The realization of the Islamic financial system is carried out by the zamzam through the goverment fund, which undertakes the support of young professionals and the main goals of the development of Muslim social infrastructure. The Zamzam fund is controlled by 12 recognized imams around the world.

The main problems that the Fund aims to resolve are:

A mass funding platform for Islamic projects that will enable any person to represent a socially important project approved by the Fund committee.

A mass funding platform for Islamic projects that will enable any person to represent a socially important project approved by the Fund committee.

- Training support for young Muslim professionals in the world's top universities.

The members of the Fund committee and the mosque, hospital and school building selected by the owners of ZAM Token.

Organization of important Muslim festivals.

Attract customers who have the opportunity to realize socially important projects.

Attract customers who have the opportunity to realize socially important projects.

There is another way for Zamzam to implement Islamic banking, which demonstrates the ideology of the Islamic financial system. Because the zamzam bank can be both an individual and a legal person, and thus acquires a movable and immovable property for a debtor who shares the risk. On the other hand, a debtor acquires a movable or immovable property from the zamzam. The price of the property includes the bank's award. According to this approach, the payday bank mortgage loans, purchase of goods and so on.

zamzam is the first or at least one of the first blockchain-based projects to implement Islamic banking in the blockchain industry. This is an important step towards a big future in which a complex Islamic convention will take place in an intelligent contract placed in Blockchain.

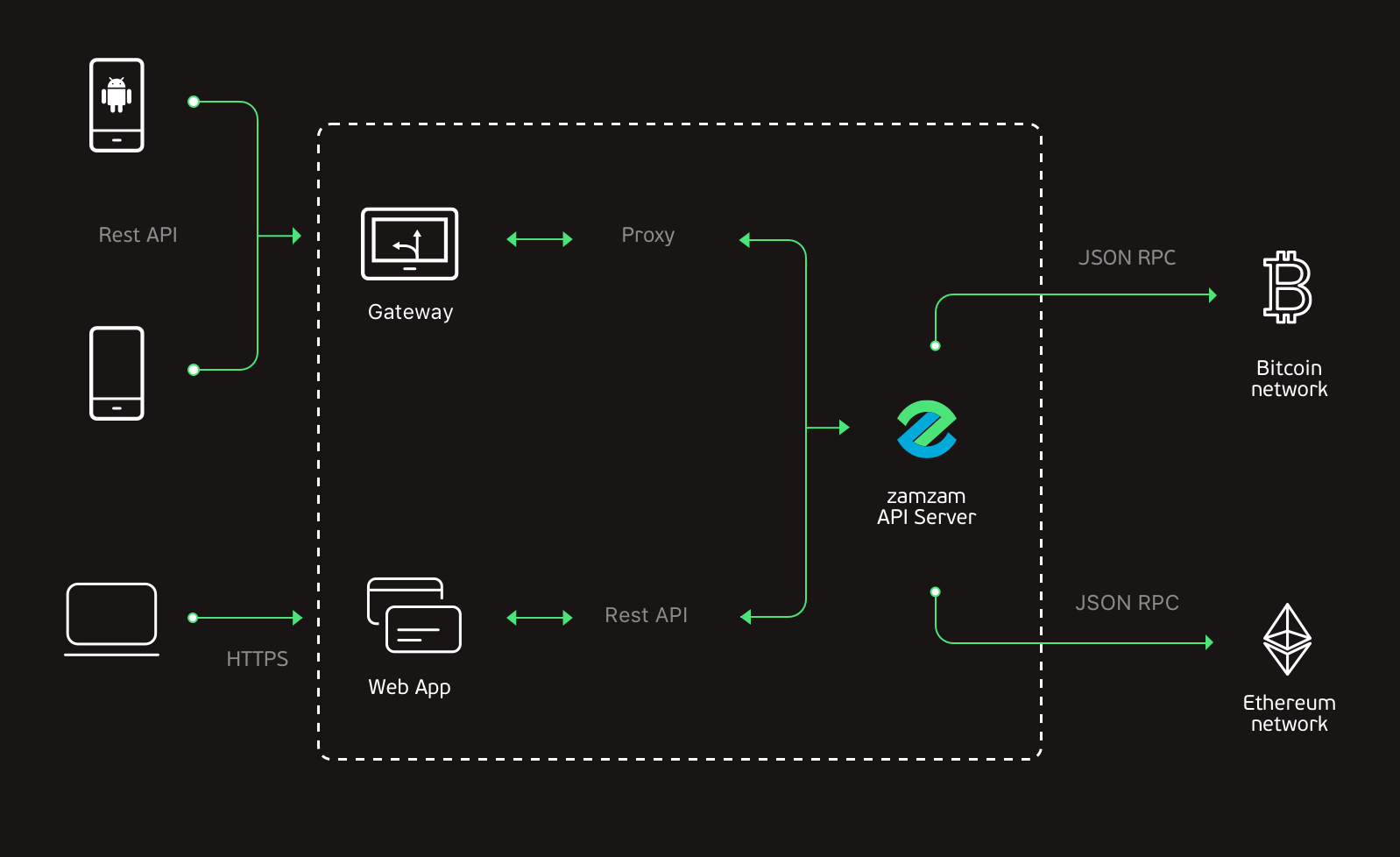

How does Zam.wallet work?

Zam.wallet is a multi-purpose wallet with a user-friendly and functional interface.

Zamzam plays an important role by serving beings in the ecosystem.

The main tasks of Zam.wallet are:

Produce and store required wallets (first for cryptos and then for fiat money)

Internal transfers between clients and withdrawal to external wallets

Currency conversion with a separate module integrated with Zam.wallet

How does it work?

Zam.wallet can be used by users of Web, iOS and Android devices. During registration, a user enters the phone number and password. The user generates additional wallets for required currencies when needed. Encryption and decryption are provided only with user passwords.

Zam.wallet can be used by users of Web, iOS and Android devices. During registration, a user enters the phone number and password. The user generates additional wallets for required currencies when needed. Encryption and decryption are provided only with user passwords.

When sending a transfer, only a recipient's phone number is required. Alternatively, the user can specify a crypto wallet address. If a recipient is not yet registered in the Zamzam database, a unique hash connection is created for such a user. The user receives an SMS indicating that the amount of money is transferred to him and must be registered in the system to receive them.

What should a buyer do?

Download the app or go to the website

Download the app or go to the website

Register

A buyer will find the money in the User

If account and transfer amount is less than $ 200, you can use them

Pass the KYC procedure (if the transfer amount is more then $ 200)

Interacting with Blockchain nodes is done with the Json-RPC API microstrap Wrapper written in Golang.

The Zamzam technical team, headed by Andrew Skurlatov, has approached the development of wallet users and the convenience features for platform users.

Web site: https://zam.io/ru

Technical documentation: https://zam.io/ZamZam%20Whitepaper%20English%2020.08.18.pdf

One-Pager: https://zam.io/ZamZam% 20One- Pager% 20English% 2020.08.18.pdf

Facebook: https://www.facebook.com/zamzambank

Twitter: https://twitter.com/zamzambank

Linkedin: https: //www.linkedin.com/company/zamzambank

Telegram: https://t.me/zamzamchat

Technical documentation: https://zam.io/ZamZam%20Whitepaper%20English%2020.08.18.pdf

One-Pager: https://zam.io/ZamZam% 20One- Pager% 20English% 2020.08.18.pdf

Facebook: https://www.facebook.com/zamzambank

Twitter: https://twitter.com/zamzambank

Linkedin: https: //www.linkedin.com/company/zamzambank

Telegram: https://t.me/zamzamchat

Bitcointalk Username: Rawon ayam

Bitcointalk Profil Link: https://bitcointalk.org/index.php?action=profile;u=1397196

Comments

Post a Comment