HADA COIN

HADA COIN

HADACoin RepresentsCkoin ERC-20 made using Ethereum platform. A total of 500 million HADACoin will be created. HADACoin will have 6 decimal units. More information on HADACoin as stated below:

- has no intrinsic value and also security,

- There is no guaranteed Monetary Provision such as Dividend, Return or anything related when buying,

- You can use your Coins to: Conduct financial activities and services on our Banking Platform, Pay for services using DBANK HADA Debit Card, Receive Monetary Projections such as Dividends, Refunds and anything equivalent to storing them in HADA DBANK Savings Account or using HADA Investment Solutions DBANK. Act as collateral when applying for Unsecured Lending and Term HADA DBANK. Market it in Crypto-Exchanges and make more profit by increasing HADACoin value

PRE-ICO (50 Million HADACoin)

Pre-ICO will commence on 20 December 2017 (00:00 EST) and end on 31 January 2018 (00:00 EST)

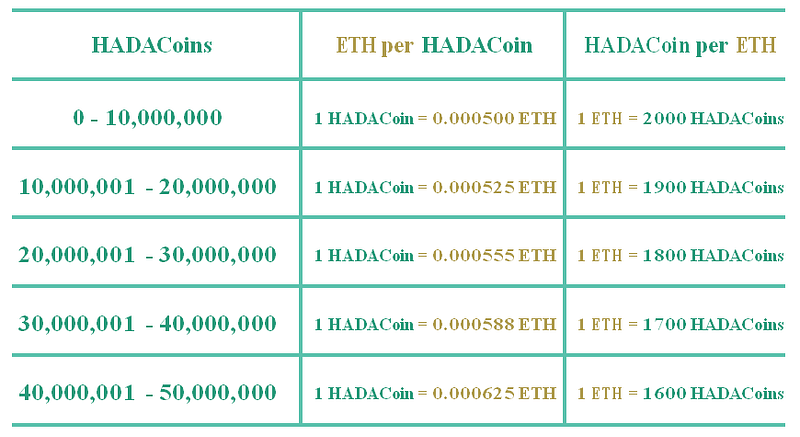

Price HADACoins during Pre-ICO

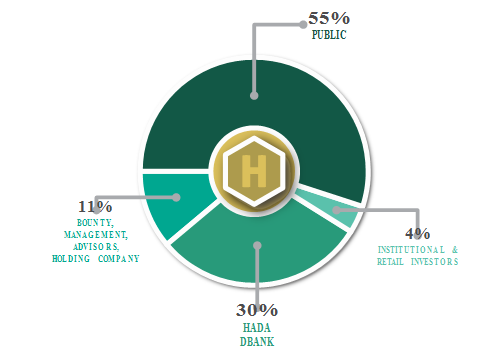

HADACoin Distribution

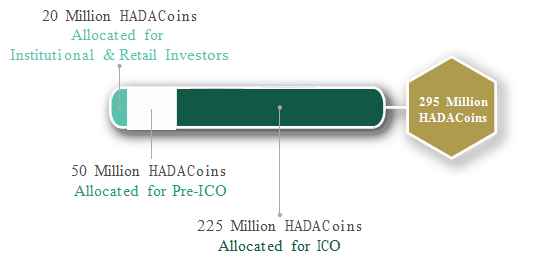

A total of 500 million hADACoins will be issued. 295 million Coin money will be sold. Outside of 295 million coins, 20 million will be allocated to private investors and institutional buyers. 50 Million coins 275 Million will be released during the PRA-ICO exercise and the remaining 225 million coins will be released in ICO practice in the near future. 10 million coins will be allocated to the gift campaign.

Pre-ICO Funding Target

Soft Cap = 5,000 ETH Hard Cap = 20,000 ETH

The remaining HADACoins that are unsold during Pre-ICO will be placed into an escrow account for future utilization.

HADACoin was created and intends to raise capital for the development of DBANK HADA. Buyers will be able to use HADACoin to conduct banking transactions or daily activities. DBANK's HADA customers will be issued with a Debit Card, which allows them to transact with HADACoin on a banking platform or other merchant globally.

HADA DBANK

HADA DBANK Sharia Banking with Blockchain Technology. HADA DBANK will become the world's first Blockchain-based Digital Bank to integrate Shariah Banking Module with Blockchain Technology, as well as to create an ethical and responsible banking ecosystem. As the existing Digital Bank and newly created Blockchain Bank focus on Conventional Banking services, DBA HADA opts for Islamic Banking services.

Islamic banks are less risky and tougher than their peers, due to aspects of their bank's capital needs and savings mobilization. Unlike Conventional Banking, depositors to Sharia Banks are entitled to be informed of what banks do with their money. They also have a vote in which their money should be invested. Sharia banks also seek to avoid interest at all levels of financial transactions and promote risk sharing between lenders and borrowers.

There are two basic principles in sharia banking. One is the sharing of profits and losses; and two, significantly, the prohibition of interest collection and payment by creditors and investors. Collecting interest or "Riba" is not permitted under Islamic law. In the case of profits, both the bank and its customers in the proportion agreed upon previously. In case of loss, all financial losses will then be borne by the lender. In addition, sharia banks can not create debt without goods and services to support it (ie physical assets including machinery, equipment, and inventory). Therefore, deposits, deposits and investments with DBAN HADA will be supported by physical assets such as precious metals and gemstones.

Syariah banking is not just for Muslims. It's for everyone. Do not let that name envelop you. Caring and Personal is the core value of DBAD's HADA, shaping and influencing services, transactions, interactions and running a business. These words will guide the behavior internally within the DBANK HADA organization, and externally with customers and society.

Mission

Provide Ethical and Responsible Banking Services to all people, especially the current "Unbanked" population

Vision

Become The Leading Global Blockchain & Digital Bank that emphasizes Ethics and Responsibilities through Sharia Banking Principles and Services

EXCLUSIVE FEATURES AND BENEFITS

1 Free encrypted account and e-wallet

a.Smartphone - App Banking

b. Non-Smart Phone - SMS / USSD Code

2. Savings and Withdrawals

a. Minimum 5% Savings Return per year

b. No withdrawal fees

3. Transfer, Remittance & Exchange

a. Transfer / Remittance of free funds (FIAT & Cryptocurrency) between personal savings account and e-wallett

b. 0% fee on exchange transactions via HADA Exchange (between cryptocurrencies). There is no charge on the main FIAT currency during FIAT exchanges

c. Connect with partners or open the API to get better interest rates for other currencies

4. Loans & Investments

a. 0% Loan Interest

b. 10% minimum investment return

5. Real-Time Payments

Real-Time Payments use HADACoin and Cryptocurrencies / Tokens via our Debit Card

Point System

Collect points from your expenses with e-Wallet or Debit Card and change into cash or in the form of Criptocurrency / token. Use it as an additional discount to pay for whatever you want and save more on your purchase. You can also use points collected to redeem anything you like in partner e-malls or physical outlets around the world.

Immediately join and gain benefit with HADA DBANK, previous list through official website, and do not forget to always get used to reading whitepaper because it contains important reviews about DBANK HADA services as well as other interesting information not listed here. Also follow important channels such as telegram, facebook, twitter and others related to DBANK HADA. Well for you also can memingikuti bounty program to get HADACOIN.

Website: https://www.hada-dbank.com/

ANN Thread Bitcointalk: https://bitcointalk.org/index.php?topic=2607739.0

Bounty Program: https://bitcointalk.org/index.php?topic=2611797.0

Twitter: https://twitter.com/HadaDBank

Author by rawon ayam

I have read this post. collection of post is a nice one Blockchain Online Training

ReplyDelete